.png?fit=outside&w=1600&h=878)

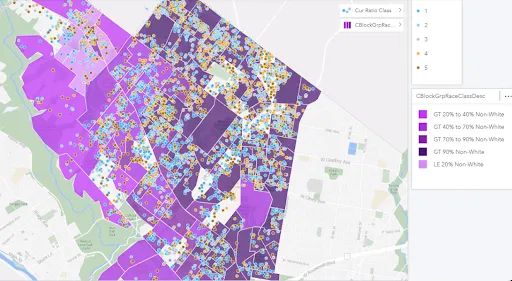

Equity Analysis

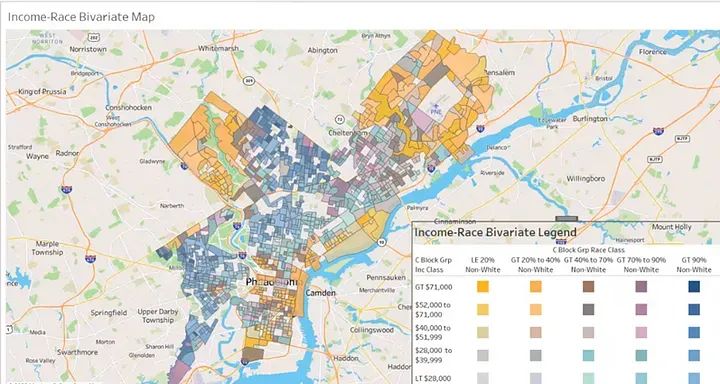

There is a perception that many jurisdictions currently over assess or overtax the poor and communities of color. There are those that consider this statement to be true without argument. I am not among them. As an advocate for racial and social justice, I believe that meaningful analysis can and should be conducted to uncover the existence of bias and that remediation can be prescribed to restore or create equity.

Municipalities that are alleged to have biased assessments run the risks of losing their credibility as objective administrators of fair and equitable property tax; losing the trust of their constituents and possibly facing legal action to force remediate of bias.

Faced with these circumstances, wouldn’t it be great to have a report that identifies the extent of bias (if any); the sources of such bias and an actionable plan for correction?

Each study includes a ratio study, a representation study and a sales disqualification study.

I have experience in examining the assessment process; conducting appropriate analysis and planning for effective remediation if needed. Let me be your advocate and your ally!

.jpg?fit=outside&w=1600&h=1206)

.jpg?fit=outside&w=1600&h=1388)

Resources

Assessment Equity Study Report for Buncombe County North Carolina June 2024

Real Property Assessment from the Viewpoint of Racial and Social Equity Part 1

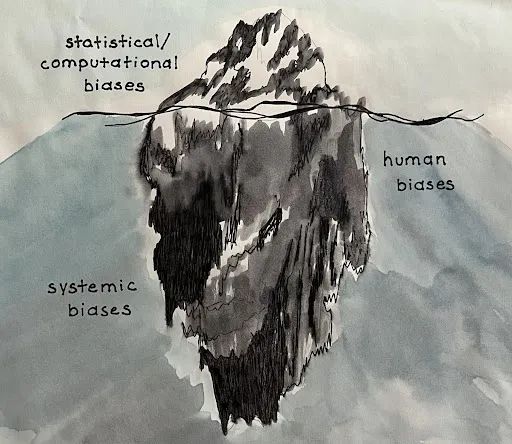

Defining the Problem: an in-depth article that defines inequity in assessments and examines the entry points for bias; why analysts frequently mis-diagnose the problem and how to defend against allegations of bias.

.webp?h=200&w=300&fit=cover)